This box is scrollable.

Genre Research Project:

Why is insulin so expensive in the United States, and what can be done to lower it?

Pictured: a glucometer. This small, portable device measures the glucose

in a person's bloodstream, letting them know if it reaches dangerous levels.

Easy to Diagnose, Hard to Cure

Like many problems here in America, the root cause boils down to a couple things: the growing wealth gap and corporate greed.At least, it does if you're looking for the short answer. I don't imagine that as an intellectually satisfying place to leave off, since it's actually a bit more complicated than that. In order to have a fighting chance at lowering insulin prices, we must first understand how this problem was created, and to do that, we must look closer at the factors that allow it to continue being a problem.

Monopolies

A monopoly is a case in which a single company holds an unfair share over the market for their respective industry. With no one to keep them in check, said company holds a terrifying amount of power: they can raise prices as much as they please without concern for quality or humanity, because they know consumers have nowhere else to go. There are laws in place to prevent these monopolies from forming, but they have loopholes and thus are not foolproof.The American insulin industry is a form of monopoly called an oligopoly, which Cornell University defines as there being "very few sellers of a given good". There are 3 main insulin manufacturers in the states: Eli Lilly, Novo Nordisk, and Sanofi. Their combined powers dominate nearly the entire global industry, meaning no one except them are controlling prices. They know full well their customers' lives depend on their product, so they have no issue raising them unfetteredly. In effect, they prey on a vulnerable population who has no choice but to come to them.

Their disproportionate market share also means that their lobbying power is equally great. Eli Lilly spent almost 9 million on total lobbying in 2024, and a report from opensecrets.org shows that the pharmaceutical industry's total lobbying expenditure has been increasing steadily since 1998. The government's bipartisan best interests, therefore, are in bowing to these pressures.

PBMs

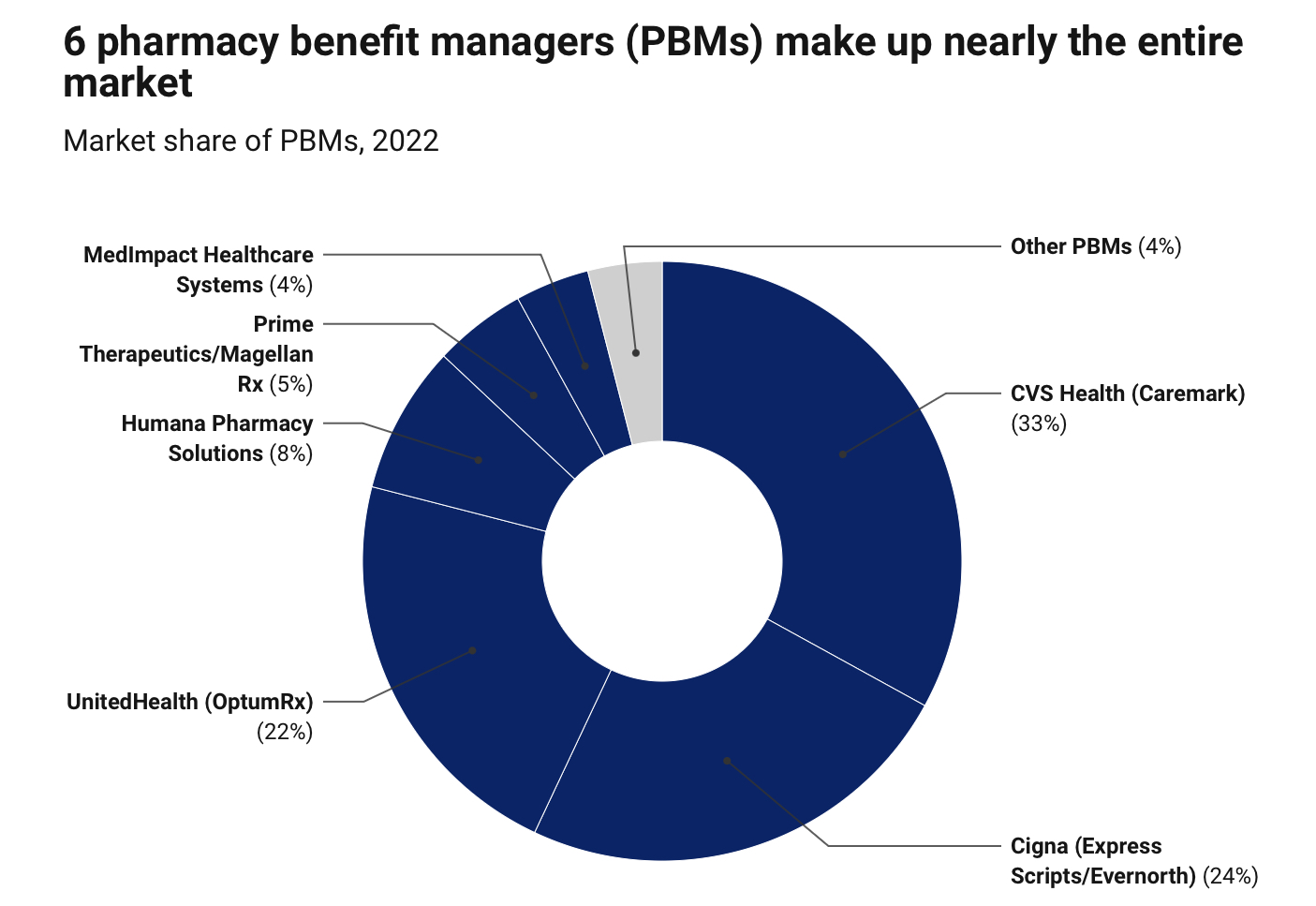

Pharmacy Benefit Managers, or PBMs, act as middlemen in the pharmaceutical industry. They work with insurance companies and drug manufacturers to mediate drug benefits and costs, effectively determining for the whole market how accessible a certain prescription medication will be to consumers.

Sourced from americanprogress.org.

PBMs are a form of oligopoly themselves, with only a handful of companies taking up a grand majority of the market. Because these PBMs stand to profit from price-gouging, and there are no laws in place forcing them to divulge pricing processes to insurers, they are a major player in the high cost of insulin. This 2021 study by Karen Van Nuys et al found that over half of insulin expenditures landed directly in the pockets of PBMs.

The VP of Health Policy at the ERISA Industry Committee, a lobby group advocating for lower prices and transparency in the healthcare field, put it succinctly in an email to journalist Nicole Rapfogel (author of one of my sources for this section):

"When PBM practices result in anything less than full transparency—from the fees they collect from drug manufacturers, to the spread they make and all of the money that should be passed through to the plan—the result is greater costs to the plan and the beneficiaries, and significant missed opportunities to help mitigate the ever-rising costs of health care borne by employers and working families."

The corruption in PBMs is no secret. Organizations like pbmaccountability.org exist to spread awareness about the shady practices of these middlemen and the role they play in the American healthcare industry's value in profit over people.

Patents and Evergreening

Patents are a legal right granted to inventors in order to prevent others from profiting off the invention in question. Patents in the United States are valid for 20 years after their initial filing, and are also typically publicly available after 18 months of this filing, meaning that anyone can access a patent's related document and the information inside for most of that 20 years. Once a patent expires, the entailed invention becomes public domain, allowing anyone to legally produce it.There's one major loophole in this time-sensitive restriction, however. There are no laws in the U.S. preventing an inventor from filing "new" patents based on existing ones. In effect, the holder of a patent can alter the packaging or some other minuscule detail of a patented product when it's about to expire, call it a new invention, and prolong their patent perpetually. The 20-year "limit" is rendered arbitrary by this fatal flaw.

The insulin industry is one of the most notorious players of this practice. It won't shock you to learn that the main three holders of all major insulin patents are the aforementioned dominant shareholders of the whole industry: Eli Lilly, Novo Nordisk, and Sanofi. Because of this, true generic versions of insulin (called biosimilars) do not exist in the United States. Unbranded alternatives do exist, but they are largely still managed by these three companies.

All these factors create a perfect storm for insulin prices to remain high in the United States.

Continue Reading

Back